Understanding Pocket Option Leverage: Benefits and Risks

https://pocket-option-kz.ru/kreditnoe-plecho/

In the world of trading, the term ‘leverage’ is often encountered. It is a tool that enables traders to multiply their exposure to financial markets without the need to commit more capital. For those involved in Pocket Option trading, understanding leverage and how it can be effectively utilized is essential. The allure of increased profit potential brought about by leverage is undeniable, yet it comes with its own set of risks.

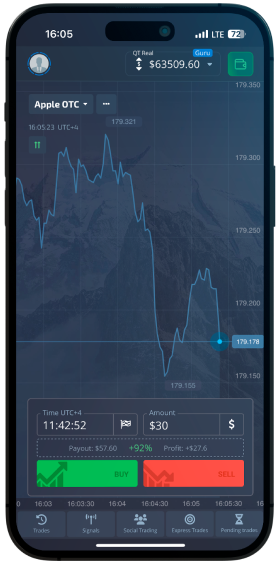

Pocket Option, a popular platform for binary options trading, offers its users the opportunity to employ leverage. In this article, we delve into the specifics of Pocket Option leverage, exploring its benefits and weighing them against potential risks. We’ll also provide insights into the strategies that traders can use to maximize the benefits of leverage while minimizing its inherent risks.

What is Leverage?

Leverage is a concept that allows traders to gain a larger exposure to the market with a relatively smaller amount of invested capital. It is expressed as a ratio, indicating how much a trader can control in the market relative to the actual amount invested. For instance, a leverage ratio of 1:100 means that with every $1 of actual capital, a trader can control $100 in the market.

The use of leverage can significantly amplify both profits and losses. This makes it a double-edged sword in trading. Proper understanding and management of leverage is crucial to prevent substantial financial losses while maximizing trading gains.

Leverage in Pocket Option Trading

Pocket Option offers leverage to empower traders with the ability to increase their market participation without the need for a large upfront capital investment. This feature can be especially attractive to new traders who may not have substantial funds but want to explore the possibilities of binary options trading. When used appropriately, leverage can substantially enhance trading profitability.

However, it’s crucial for traders to carefully consider the leverage ratio they choose. Pocket Option provides various leverage levels, which can be tailored to meet the trader’s risk appetite and trading strategy. Beginners are often advised to start with lower leverage ratios to minimize risk.

Benefits of Using Leverage on Pocket Option

- Amplification of Profits: One of the main draws of leveraging is the ability to amplify profits. A trader with successful predictions can generate significant returns with a relatively small initial investment.

- Market Accessibility: Leverage allows traders to enter larger positions that would otherwise require substantial capital. This accessibility is particularly beneficial for new traders or those with limited financial resources.

- Diversification: Leverage enables diversification of trading activities across different assets or strategies, allowing traders to potentially reduce risk exposure per asset.

Potential Risks of Leverage

- Amplification of Losses: Just as profits can be amplified, so can losses. This is perhaps the most significant risk associated with leverage.

- Over-leveraging: Utilizing high leverage without proper risk management can lead to substantial losses and in some cases, account depletion.

- Emotional Trading: The pressure of leveraged trading can lead to emotional decision-making, which can be detrimental to a trader’s strategy and overall success.

Risk Management Strategies

Managing risk is crucial when trading with leverage. Here are some strategies that can be employed:

- Use Risk Management Tools: Stop-loss and take-profit orders should be used judiciously to mitigate potential losses and secure profits.

- Start Small: Beginners should start with small leverage ratios to gain familiarity with market movements and trading dynamics.

- Educate Yourself: Continuously learn about market trends and strategies to make informed decisions when utilizing leverage.

Conclusion

Pocket Option leverage can be a powerful tool for traders aiming to enhance their market participation and potentially amplify their profits. However, it comes with inherent risks that must be understood and managed effectively. By employing proper risk management strategies and continuously educating themselves, traders can harness the power of leverage while safeguarding their investments against significant losses.

As with any financial instrument, it is important to weigh both the potential rewards and the risks involved. By doing so, traders can ensure that they make the most informed decisions in their trading endeavors.